Selling a business is a significant undertaking, demanding meticulous planning and execution. This comprehensive guide provides a structured approach to preparing your business for sale, encompassing crucial financial, legal, operational, and marketing considerations. From evaluating your financial health to fostering positive customer and employee relationships, each aspect is meticulously examined to ensure a smooth and successful transition.

The process involves navigating complex legal frameworks, optimizing operational efficiency, and developing a compelling marketing strategy to attract potential buyers. Thorough due diligence and a fair valuation are essential components of a successful sale. This guide will equip you with the knowledge and tools to navigate these key areas and maximize the value of your business.

Financial Preparation

Thorough financial preparation is crucial for a successful business sale. A well-documented and analyzed financial picture provides potential buyers with confidence and allows for a fair valuation, ultimately leading to a smoother transaction. This section details the financial processes involved, emphasizing methods for evaluating financial health, organizing records, and negotiating financing.A comprehensive financial review is essential for maximizing the value realized from the sale.

It allows for a precise assessment of the business’s current state, revealing strengths and weaknesses that may influence the pricing strategy and negotiation process.

Financial Statement Analysis

Understanding the business’s financial health involves a detailed examination of key financial statements. These statements, including the income statement, balance sheet, and cash flow statement, provide a snapshot of the business’s performance over a specific period.

- Income Statement: This statement tracks revenues and expenses over a period, highlighting the business’s profitability. Analyzing trends in revenue and expenses allows for identifying patterns and potential areas for improvement. For instance, a consistent increase in revenue over several years indicates strong growth, while a sudden spike in expenses might signal an operational issue requiring attention. Comparing the income statement to previous periods is essential for assessing performance and identifying any discrepancies.

- Balance Sheet: The balance sheet provides a snapshot of the business’s assets, liabilities, and equity at a specific point in time. It helps assess the business’s liquidity and solvency, providing insights into its ability to meet short-term and long-term obligations. A healthy balance sheet demonstrates the business’s financial stability and strengthens its appeal to potential buyers.

- Cash Flow Statement: The cash flow statement details the movement of cash into and out of the business over a period. It’s crucial for understanding the business’s ability to generate cash, which is critical for operating expenses and potential debt repayment. Positive cash flow signifies a healthy financial position, while negative cash flow may require attention and strategic adjustments before the sale.

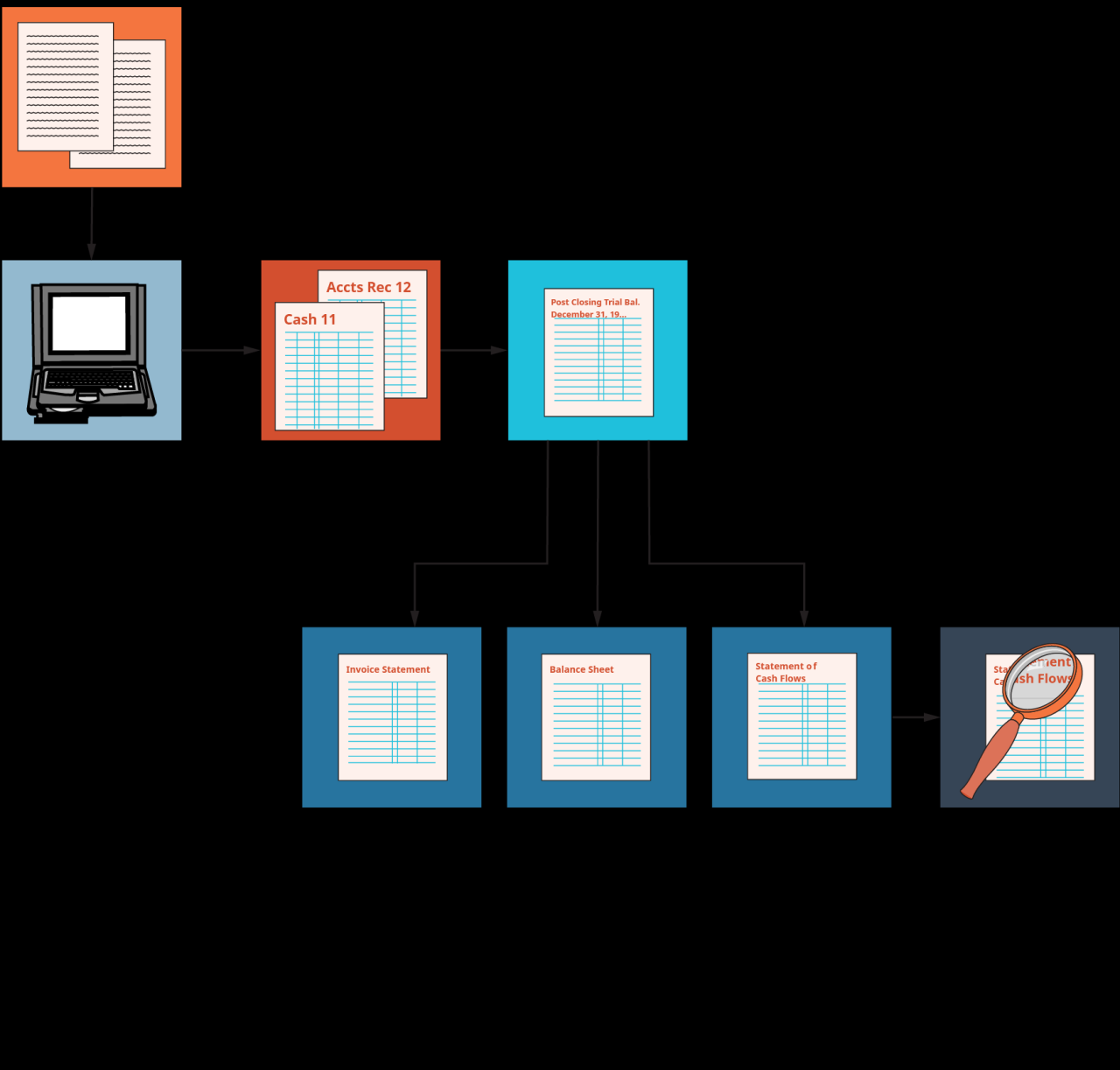

Record Organization for Sale

Organized financial records are paramount for a smooth and efficient sale process. Clear and concise presentation of financial data builds trust and confidence in the business’s value. It allows potential buyers to quickly assess the financial performance, minimizing the time and effort required for due diligence.

- Detailed Accounting Records: Maintain meticulous records of all transactions, ensuring accurate and complete financial statements. This includes invoices, receipts, and supporting documents for every financial activity.

- Financial Policies and Procedures: Document all internal financial policies and procedures. Consistency and transparency in these procedures demonstrate strong internal controls and attract potential buyers.

- Tax Returns and Compliance Documents: Provide all relevant tax returns and compliance documents. This demonstrates the business’s adherence to regulations and minimizes potential issues for the buyer.

Negotiating Financing Options

Securing financing for the sale process is often a critical component. Understanding the various financing options and negotiating favorable terms can be beneficial to both the seller and buyer.

- Seller Financing: Consider offering seller financing to the buyer. This option allows the buyer to assume the business’s debt obligations and facilitates a faster closing. Seller financing should be carefully structured and thoroughly documented.

- Bank Loans: Exploring financing options from banks and other financial institutions is essential for both the seller and buyer. A strong financial profile and positive track record can improve the likelihood of securing a loan.

- Private Investors: Attracting private investors to fund the purchase can provide access to capital that is not available through traditional financing channels. This requires careful assessment of the potential investor’s interests and the terms of the investment.

Financial Metrics for Valuation

Evaluating a business’s worth involves understanding key financial metrics. These metrics provide a comparative framework to assess the business’s financial performance and value relative to industry benchmarks.

| Metric | Definition | Importance |

|---|---|---|

| Revenue | Total income generated from sales | Primary indicator of business size and potential |

| Expenses | Costs incurred in running the business | Essential for assessing profitability and efficiency |

| Profit Margin | Percentage of revenue remaining after expenses | Indicates profitability and efficiency of operations |

| Debt-to-Equity Ratio | Ratio of total debt to total equity | Measures the business’s financial leverage and risk |

| Return on Investment (ROI) | Ratio of net profit to total investment | Indicates profitability and attractiveness for investment |

Legal and Regulatory Compliance

Preparing your business for sale involves navigating a complex web of legal and regulatory requirements. Thorough understanding and meticulous compliance are crucial to a smooth transaction and to minimizing potential risks. This section will delve into the critical legal aspects and regulatory considerations to ensure a successful sale.The legal landscape surrounding business sales is multifaceted. It encompasses contracts, intellectual property rights, potential liabilities, and various regulatory hurdles.

Understanding these facets is essential to protect the interests of both the seller and the buyer. Addressing these concerns proactively safeguards the entire process and minimizes potential disputes.

Legal Aspects of Business Sales

The sale of a business necessitates careful consideration of legal contracts, intellectual property, and potential liabilities. Contracts, including purchase agreements and non-disclosure agreements, must be meticulously crafted to clearly Artikel the terms and conditions of the transaction. Intellectual property rights, such as trademarks, copyrights, and patents, must be accurately identified and transferred. The identification and proper handling of these aspects are essential to avoiding future disputes.

Similarly, potential liabilities, such as outstanding debts or pending lawsuits, must be thoroughly assessed and addressed. A comprehensive legal review can identify and mitigate potential risks, thereby safeguarding the business and its owners.

Regulatory Requirements

Meeting regulatory requirements before and during the sale process is paramount. Regulatory compliance is critical for a smooth transaction. These requirements vary based on the industry, jurisdiction, and the specific nature of the business. Accurate and complete compliance with all relevant regulations, including tax laws, employment laws, and environmental regulations, is crucial. Non-compliance can lead to significant penalties and legal issues.

Businesses should meticulously review and comply with all relevant state and federal regulations.

Potential Legal Risks and Issues

Potential legal risks and issues during a business sale can arise from various sources. These include, but are not limited to, disputes over contract terms, misrepresentation of assets, undisclosed liabilities, or intellectual property infringements. Furthermore, changes in market conditions, regulatory environments, or even the actions of third parties can introduce unforeseen challenges. Thorough due diligence and professional legal counsel are essential to mitigate these potential risks and to navigate the complexities of the sale process.

Comprehensive legal due diligence and careful contract negotiation are essential tools for risk mitigation.

Strategies for Mitigating Legal Risks

Several strategies can help mitigate legal risks during the business sale process. These include conducting a thorough due diligence process, seeking professional legal counsel, and meticulously reviewing all contracts. Moreover, proactively identifying and disclosing all potential liabilities and regulatory requirements is crucial. A proactive approach minimizes the potential for unforeseen issues.

Key Legal Documents for Business Sale

| Document | Purpose | Significance |

|---|---|---|

| Purchase Agreement | Artikels the terms and conditions of the sale. | Defines the rights and obligations of both parties. |

| Non-Disclosure Agreement (NDA) | Protects confidential information during the sale process. | Prevents the disclosure of sensitive business data. |

| Asset Purchase Agreement | Details the transfer of specific assets. | Specifies the assets being sold and the liabilities assumed. |

| Bill of Sale | Formal transfer of ownership of tangible assets. | Legally documents the transfer of ownership. |

| Employment Agreements | Addresses the transfer of employees. | Defines the responsibilities and obligations related to employment. |

Operational Optimization

Optimizing operational efficiency is crucial for enhancing a business’s value proposition during a sale. A streamlined operation, lower costs, and higher productivity all contribute to a stronger financial picture, making the business more attractive to potential buyers. A well-defined operational structure, demonstrating consistency and predictability, is vital for conveying a robust and reliable business model.A robust operational structure provides a clear pathway for future growth and stability, key factors that potential buyers seek when evaluating a business for purchase.

It fosters a culture of efficiency and productivity, which are key components of long-term success. This clarity and structure can directly influence the sale price and overall transaction value.

Strategies for Improving Operational Efficiency

Implementing strategies for operational efficiency will yield substantial benefits during the sale process. These strategies include meticulous process analysis and implementation of improvements, cost reduction initiatives, and productivity enhancement techniques.

- Process Streamlining: Identifying and eliminating bottlenecks in current processes is paramount. This involves detailed mapping of existing workflows to identify areas for improvement. Utilizing tools like flowcharting or process mapping software can help visualize and analyze existing processes, enabling the identification of inefficiencies and redundancies. Examples include automating manual tasks, reducing paperwork, or implementing more efficient inventory management systems.

This streamlines processes, reduces errors, and increases overall operational efficiency.

- Cost Reduction Initiatives: A thorough analysis of current expenses is essential. This involves scrutinizing all operational costs, from utilities to staffing, and exploring opportunities for reduction. Examples include negotiating better contracts with suppliers, optimizing energy consumption, and evaluating staffing levels to ensure they are aligned with current operational needs. Implementing these cost-cutting measures directly increases the perceived value of the business for potential buyers.

- Productivity Enhancement Techniques: Investing in training and development programs for employees can dramatically improve productivity. Providing employees with the necessary tools and resources, such as advanced software or specialized equipment, also contributes to higher productivity levels. Implementing performance management systems that provide clear expectations and track progress can further enhance productivity. This demonstrates a commitment to operational excellence and efficiency, a factor that significantly enhances the perceived value of the business.

Comparison of Operational Models

Comparing different operational models is vital for identifying the optimal structure for the sale. This involves evaluating various models, including centralized, decentralized, and hybrid models.

| Operational Model | Description | Suitability for Sale |

|---|---|---|

| Centralized | Decision-making and operations are concentrated in a central location. | Can be efficient for standardized operations but might not appeal to buyers seeking flexibility. |

| Decentralized | Decision-making and operations are distributed across various locations or departments. | Can be appealing to buyers seeking autonomy and regional expertise, but may require more coordination. |

| Hybrid | Combines aspects of centralized and decentralized models. | Often the most suitable model, offering a balance between efficiency and flexibility. |

Steps to Improve Operational Processes Before Sale

A comprehensive plan is necessary to improve operational processes prior to the sale. This involves a detailed, actionable plan to optimize the business’s operations.

- Detailed Process Documentation: Thoroughly document all existing operational processes, procedures, and workflows. This allows potential buyers to quickly understand and assess the business’s operational capabilities. This documentation should be easily accessible and understandable.

- Technology Integration: Evaluate and implement relevant technology solutions to streamline processes, improve data management, and enhance communication. This could include implementing an Enterprise Resource Planning (ERP) system or upgrading existing software.

- Employee Training and Development: Ensure all employees are properly trained and equipped to perform their tasks efficiently and effectively. This improves consistency and predictability, crucial factors for a smooth transition.

Importance of Organizational Structure

A well-defined organizational structure is essential in preparing for a sale. This structure should clearly delineate roles, responsibilities, and reporting lines, demonstrating the business’s operational organization.

- Clear Reporting Structure: A clearly defined reporting structure ensures accountability and responsibility, enhancing the overall effectiveness of the business. This is vital for potential buyers to assess the organizational hierarchy and understand the flow of information and authority.

- Defined Roles and Responsibilities: Clearly defining roles and responsibilities within the organization minimizes ambiguity and maximizes efficiency. This transparency allows potential buyers to quickly understand the structure and potential for future growth.

Marketing and Branding

A strong brand and marketing strategy are crucial for attracting potential buyers and maximizing the value of your business sale. A well-defined brand communicates the unique value proposition of the business, making it stand out in the competitive marketplace. This clear communication fosters trust and confidence, ultimately leading to a more favorable transaction. Effective marketing strategies showcase the business’s strengths and appeal to the specific needs of potential buyers.A well-executed marketing campaign during the sale process significantly increases the chances of a successful transaction.

This involves actively promoting the business to the right audience, highlighting key selling points, and building interest among prospective buyers.

Importance of a Strong Brand Identity

A compelling brand identity is essential for presenting a cohesive and trustworthy image to potential buyers. This involves establishing a clear brand message, visual identity (logo, colors, typography), and consistent brand voice across all marketing materials. This consistency builds recognition and strengthens the perceived value of the business.

Strategies for Showcasing Value Proposition

Highlighting the business’s value proposition is key to attracting the right buyers. This involves clearly articulating the unique benefits and advantages that the business offers. Potential buyers should understand the return on investment (ROI) they can expect. For instance, if the business has a loyal customer base, this should be prominently featured, along with any significant market share or growth trajectory.

Quantitative data, such as revenue figures and profit margins, can also demonstrate value.

Methods for Promoting the Business for Sale

Several methods can effectively promote a business for sale. Advertising through targeted online channels, such as industry-specific websites or social media platforms, can reach potential buyers actively seeking acquisitions. Networking events within the industry can facilitate valuable connections and introduce the business to potential investors or buyers. Utilizing professional business brokers or intermediaries can also significantly increase visibility and efficiency in the sales process.

Promoting Unique Selling Points (USPs)

Effective promotion emphasizes the business’s unique selling points (USPs). These are the specific characteristics or attributes that differentiate the business from competitors. Clearly articulating these points will help potential buyers understand the value proposition and how the business can meet their specific needs. Examples include proprietary technology, a strong intellectual property portfolio, or a highly skilled and experienced team.

Emphasizing these elements helps position the business as a desirable acquisition.

Comparison of Marketing Strategies

| Marketing Strategy | Description | Pros | Cons |

|---|---|---|---|

| Direct Sales | Reaching out directly to potential buyers through personal contacts, networking, and targeted outreach. | Direct interaction fosters trust and allows for customization of the message. | Requires significant time investment and may not reach a wide audience. |

| Online Marketing | Utilizing digital channels such as social media, online advertising, and industry-specific websites to promote the business. | Wider reach, potentially lower cost compared to traditional advertising, measurable results. | Requires ongoing effort and expertise to manage campaigns effectively. |

| Networking Events | Participating in industry conferences, trade shows, and other networking events to connect with potential buyers. | Opportunity for face-to-face interaction, building relationships, generating leads. | Can be costly in terms of time and resources, and may not guarantee immediate results. |

Customer and Employee Relations

Maintaining positive customer and employee relations is critical during a business sale. Strong relationships with both groups foster goodwill, minimize disruption, and ultimately contribute to a smoother transition and a successful sale. This section details strategies to manage these crucial aspects of the process.Effective communication is paramount. Transparency with customers and employees about the sale process builds trust and mitigates anxieties.

Open dialogue demonstrates respect and prepares both groups for the change. Implementing proactive strategies for employee retention and customer engagement is crucial for maintaining a strong foundation.

Maintaining Positive Customer Relationships

Transparency and clear communication are key to maintaining customer loyalty during a sale. Communicating the change early and often, while reassuring customers of ongoing service quality, builds trust and avoids uncertainty. A formal announcement, outlining the sale process and any potential impacts on services, is highly recommended. Emphasizing continuity and the commitment to maintaining service levels is crucial.

Communicating with Customers About the Upcoming Sale

A well-structured communication plan should include multiple channels to reach customers. This could include email updates, announcements on the company website, social media posts, and perhaps even direct mail. Consistent messaging, emphasizing the benefits of the sale (e.g., continued service, improved resources), is vital. Regular updates on the sale progress, timelines, and key personnel changes can also be included.

This demonstrates the business’s commitment to its customers and fosters trust.

Managing Employee Relations During the Transition Period

Open communication with employees is essential during the transition. Providing clear and concise information about the sale process, potential changes to roles and responsibilities, and the future of the company is crucial. Address any employee concerns promptly and professionally. This proactive approach minimizes uncertainty and anxieties, encouraging a positive transition.

Strategies for Retaining Key Employees

Retaining key employees is vital for a successful transition. Highlight the value proposition of the sale for employees, emphasizing opportunities for growth and advancement. Transparency regarding the future of the company, including employee roles and the potential for continued employment, fosters loyalty. Offer incentives for employees to remain, such as bonuses, performance-based rewards, and opportunities for continued training.

The value of these employees to the future of the company should be highlighted.

Employee Communication Protocols for a Smooth Transition

A structured communication plan is necessary for a smooth transition. This plan should Artikel who will be responsible for communicating updates, what the channels will be, and how frequently information will be shared.

- Establish a dedicated communication channel (e.g., email list, intranet forum) for employee updates.

- Schedule regular meetings or Q&A sessions to address employee concerns.

- Clearly define roles and responsibilities during the transition period.

- Develop a plan for training and development to prepare employees for any changes in their roles.

- Implement a process for handling employee questions and feedback.

These protocols help ensure a consistent and transparent flow of information, promoting a smoother transition and preserving employee morale. By addressing employee concerns and providing clear direction, the company can cultivate a positive and productive work environment during the transition period.

Due Diligence and Valuation

Preparing your business for sale requires a thorough understanding of its value and a meticulous review of its operations. This process involves a critical assessment of the business’s financial health, legal compliance, and operational efficiency, all of which contribute to the final valuation. This crucial stage ensures a fair price for the business and minimizes potential risks for both the seller and buyer.The due diligence process is a systematic investigation of the business’s strengths and weaknesses.

This is not simply a superficial overview, but a detailed examination of all aspects of the business, from its financial records to its customer relationships. A comprehensive valuation, determined through various methods, is essential for establishing a fair price that reflects the true worth of the business. This accurate valuation provides a benchmark for negotiations and helps ensure a mutually beneficial transaction.

Due Diligence Process Overview

The due diligence process is a multi-faceted investigation into all aspects of the business. It typically involves a detailed examination of financial statements, legal documents, operational procedures, and other relevant information. This rigorous process allows potential buyers to assess the true value of the business and identify any potential risks or liabilities.

Accurate Valuation Importance

Accurate valuation is critical for a successful sale. A precise valuation not only sets a fair price but also helps avoid misunderstandings between the buyer and seller. A correctly determined valuation allows for informed negotiation and a smoother transaction process. It helps both parties reach an agreement that reflects the true value of the business and the market conditions.

For example, an undervalued business might lead to missed opportunities for the seller, while an overvalued business could deter potential buyers.

Valuation Methods Comparison

Several valuation methods exist, each with its own strengths and weaknesses. The most common methods include discounted cash flow (DCF) analysis, comparable company analysis, and asset-based valuation.

- Discounted Cash Flow (DCF) Analysis: This method estimates the present value of future cash flows generated by the business. It’s particularly useful for businesses with stable and predictable cash flows. For example, a mature manufacturing company with consistent earnings might be well-suited for DCF analysis.

- Comparable Company Analysis: This method compares the subject business to similar businesses that have been sold recently. This method relies on market data and is effective when comparable businesses exist in the same industry and market. For instance, comparing a software company to other recently acquired software firms can provide a good benchmark.

- Asset-Based Valuation: This method values the business based on the fair market value of its assets. This approach is frequently used for businesses with significant tangible assets, such as equipment or real estate. For example, a manufacturing company with substantial machinery might be best valued using this method.

Financial Document Preparation

Preparing financial documents for a potential buyer’s review is a critical step in the sales process. It’s important to present clear, concise, and accurate information. The documents should be readily accessible, properly formatted, and in line with industry standards.

- Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, provide a snapshot of the business’s financial health. These statements should be audited or reviewed by a qualified accountant for accuracy and compliance.

- Tax Returns: Providing complete and accurate tax returns, going back several years, allows a potential buyer to evaluate the business’s tax liabilities and compliance history.

- Other Financial Records: This might include bank statements, loan documents, and other relevant financial records. All these provide a comprehensive view of the business’s financial position and transactions.

Due Diligence Process Steps

The due diligence process is a crucial step in a business sale. It helps to ensure that the buyer understands the true financial, legal, and operational condition of the business.

| Category | Specific Steps |

|---|---|

| Financial Review | Reviewing financial statements, tax returns, and other financial records; assessing historical performance and projected future earnings; conducting a detailed analysis of financial ratios; identifying potential liabilities. |

| Legal Review | Examining contracts, licenses, permits, and intellectual property rights; evaluating legal compliance with relevant regulations and laws; identifying potential legal disputes or liabilities. |

| Operational Review | Assessing the efficiency and effectiveness of operational processes; evaluating the quality of management and employees; identifying potential risks or inefficiencies in day-to-day operations. |

Wrap-Up

In conclusion, preparing your business for sale is a multifaceted process that requires careful planning and execution. By addressing financial health, legal compliance, operational optimization, marketing strategies, customer relations, and the due diligence process, you can position your business for a successful sale. This guide offers a roadmap for navigating these crucial steps, ensuring a smooth transition and maximizing the value of your enterprise.